04/23/2024

Reader Question: Should I Pay Off My Mortgage Early?

Geoffrey Schaefer, CFP®

This is probably one of the most frequent questions I get from clients and prospective clients. With the rise in mortgage rates the past 18 months, it is more relevant now than ever. So, should you pay off your mortgage early?

I believe this question has two parts. The first effects the second, but ultimately, the second part is the final decision maker.

- First is the math of it all.

- Second is the feelings of it all.

So, the math. According to the Apollo Group, 61% of outstanding mortgages are below 4%. So we can use 4% as a decent base case.

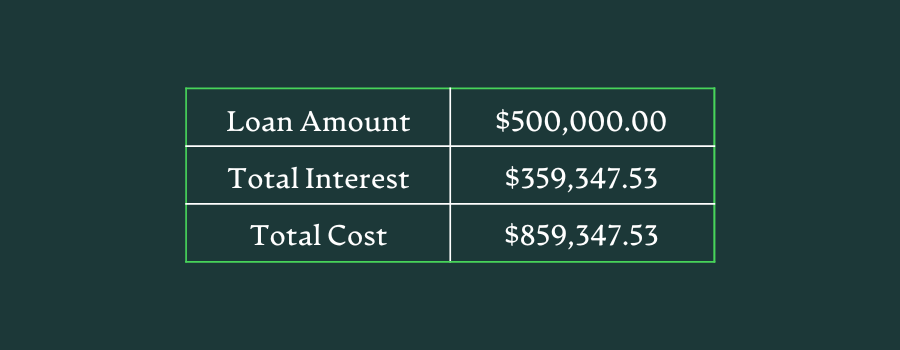

Let’s buy a $500,000 house using a 30 year mortgage. Not including taxes and insurance (because you will pay those regardless), your monthly payment would be $2,387. By paying exactly according to schedule, you would have paid:

Not too bad. But now, enter the question, “I have $500 extra per month, should I save, invest or pay off debt?”

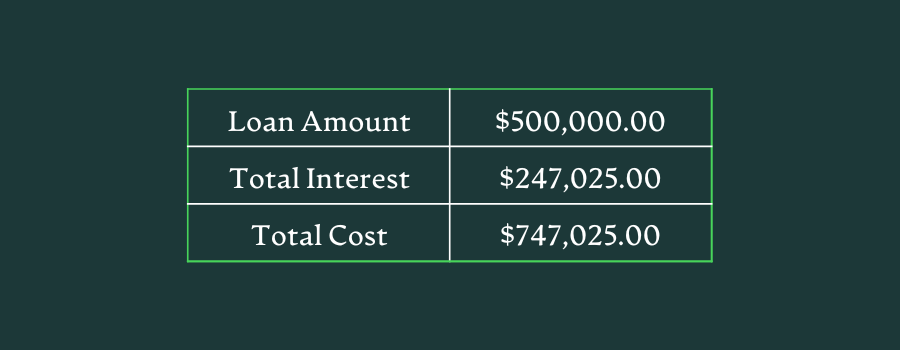

How much interest do we save over the life of the loan by paying an extra $500 per month?

You would have lowered your 30 year mortgage to 21.5 years and your new loan cost would be:

A savings of 8.5 years of cash flow and $112,322.53 off the 30 year schedule. Not too bad at all, actually pretty great, but can we do better?

Two alternatives are to save and invest the money.

For saving, we will use a rate of return of 4%, similar to many high yield savings accounts.

For investing, we will assume a rate of return of 7.5% which is the average annual return of a 70% stock, 30% bond portfolio over the past 21 years.

The question we are looking for in these alternatives is, if we choose one and stick with it for the same timeframe as our projected mortgage payoff, do we net out more?

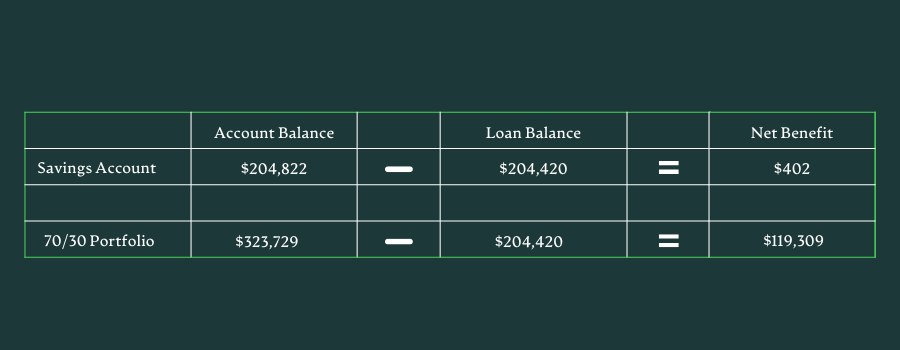

Savings Scenario- 4% Rate of Return $500/m contribution for 259 months

$500 per month into your high yield savings account would have grown to $204,822 after 259 months.

Investment Scenario – 7.5% Rate of Return. $500/m contribution for 259 months

A $500 per month contribution investment portfolio of 70% stocks and 30% bonds would have grown to a balance of $323,729 after 259 months (21.5 years).

Assuming you are paying your mortgage according to schedule in both scenarios, after the 259th month, you would still owe an outstanding balance of $204,419.

If we want the house paid off in 21.5 years, here’s what it looks like:

So, saving the difference netted you $402 over 21.5 years or just over $18 per year. Maybe not worth it, especially since rates on savings accounts can change much more easily than rates on your mortgage. Bottom line, a savings interest rate close to your mortgage rate is a draw. If you value flexibility, cash savings could be the answer. If you like the knowns and certainty, pay off the debt as the interest is a known cost.

What is compelling is investing. The $119,309 swing is significant and could change your financial situation quite a bit. Historically, the more stocks you move into the allocation, the better your long-term return, but the unknown of future returns is the tradeoff for the clear opportunity. The bottom line here is, if you have the time, the opportunity of the stock market is attractive. A shorter pay-off window means less time in the market which means more variability of outcomes both good and bad. By that I mean, when investing for shorter periods, you could potentially end up with a plus 41% return just as likely as you could get a 7% return or a negative 25% return.

On top of both of these scenarios, you now have 8.5 years to save and invest what you were paying for your mortgage. So take that leftover investment account of $119,309. Now that your mortgage is paid, add the $2,387 per month and at the end of the original 30 year period, you could have a $560,612* account. Not bad at all.

*all based on a 7.5% market return estimation*

Big factors to consider for the math part:

- Mortgage Interest Rate

- Time left on the mortgage (or time you’d like to have it paid off by)

- Alternative savings or investment return

So, the math part is good to go. Now, to quote the philosophical film, The Notebook, “What do you want?”

If the Milky Way Galaxy was your lifetime of your decisions, the financial and mathematical decisions would be something like Earth. Yeah, we humans are big fans of earth, but given the entire galaxy, there is a lot more to it. The other planets, all of the stars, the black holes that creep us all out a bit, the moon, the sun! There is a lot more to it. Math drives some financial choices, but in the scheme of your life you likely make most of your choices by something other than mathematical sense. Values, purpose, religion, profession, family, even selfishness all drive decisions that no math or even reason could combat.

Some questions to help us figure out what we want…

- Is debt crippling to us?

- Why do we view debt in a negative or indifferent light?

- How were we raised to think about debt?

- Does being debt free sooner rather than later affect the outcome of my long-term vision?

- Is being debt free a goal that ranks higher than others according to what I truly value?

Everyone’s answers to these will be different. After all, personal finance is… personal.

If you have anxiety when you think about debt and would live a happier life being debt free, perhaps it is prudent for your lifestyle to paydown the mortgage sooner rather than later. Maybe you appreciate the opportunity to earn more appreciation and income elsewhere like the stock market or a business so you forgo the repayment of the debt for flexibility and appreciation. Decide what really matters to you.

Once you know what you value today and where you want to be tomorrow, bring the math back in and make the best decision to support that. In reality, a plan that does not support your abilities and peace of mind today is ill suited to accomplish your goals in the future.

Factors to consider for the feelings part:

- Feelings toward debt

- Long term vision

- Need for flexibility

- Desire to maximize opportunity

- Family values

Wrapping up with the original question, “Should I pay off my mortgage early?”

It truly depends. Based off your interest rate and the time you are shooting for, work with someone who will help you figure out the math of it all and then listen to you as you sort through the “what do you want?” question.

Follow us on social media below: