08/23/2024

529 to Roth IRA Rollovers

A 529 Account is a powerful savings vehicle for education specific goals. Historically, the primary criticism of this account was the lack of flexibility. Penalties and taxes for non-qualified withdraws made some savers shy away while others simply didn’t want to commit to saving money to pay for a four-year institution when they have no idea what their newborn baby’s goals will be in 18 years. While the account still has more limitations than most, a lot of legislative progress has occurred the past several years to make these accounts more flexible and practical to the average American saver. Changes include qualified withdraws for trade schools, qualified withdraws for private K-12 schools, and student loan repayment. The most drastic and noteworthy is the ability to roll funds from a 529 to a Roth IRA.

This new feature has a lot of investors rethinking the 529 Account. Here is what you need to know about rolling your education account into a Roth IRA:

- The 529 account must have been open for more than 15 years.

- This one is pretty self-explanatory. If you are starting a 529 account for an older child, know that this 15-year period must be satisfied before you can roll funds from the 529 into a Roth IRA. If you start an education account for your 15-year-old, they will be 30 when you can roll over the unused funds.

- The funds must be rolled over to a Roth IRA owned by the 529 account beneficiary.

- Here’s an example: If your son is the 529 beneficiary, the Roth IRA must also be owned by your son. You can change a beneficiary on a 529 account, so if the funds are meant to be directed to a certain family member, ensure the 529 is matched to their Roth IRA.

- There are no tax consequences or penalties when a 529 plan beneficiary is changed to a member of the beneficiary’s family. Qualified family members include the beneficiary’s:

- Spouse

- Son, daughter, stepchild, foster child, adopted child or a descendent

- Son-in-law, daughter-in-law

- Siblings or step-siblings

- Brother-in-law, sister-in-law

- Father-in-law, mother-in-law

- Father or mother or ancestor of either, stepmother, stepfather

- Aunt, uncle or their spouse

- Niece, nephew or their spouse

- First cousin or their spouse

- There are no tax consequences or penalties when a 529 plan beneficiary is changed to a member of the beneficiary’s family. Qualified family members include the beneficiary’s:

- Here’s an example: If your son is the 529 beneficiary, the Roth IRA must also be owned by your son. You can change a beneficiary on a 529 account, so if the funds are meant to be directed to a certain family member, ensure the 529 is matched to their Roth IRA.

- The rollover amount cannot exceed the annual IRA contribution limits.

- In 2024, this is $7,000. So, no more than $7,000 can go into the account AND this counts as the 2024 contribution. You may be familiar with 401(k), TSP, or 403(b) rollovers which are not subject to the annual contribution cap. The 529 rollover does not adhere to the same logic.

- In addition to this counting as the year’s contribution, the beneficiary must have earned income to match or exceed the amount being transferred. If the beneficiary only earns $5,000 at a part time job that year, only $5,000 can be transferred. If they earn $7,000 or more (in 2024), the full annual contribution can be rolled over.

- The eligible rollover amount must have been in the 529 account for at least 5 years.

- This is a reason to open 529 accounts while your kids are in grade school even if you plan on only funding them minimally. A big thing to understand with this rule is how it works with the 15-year rule. You may have had the account open for 15 years, but most of the funding occurred in the last five years. This means all contributions and investment growth is ineligible to roll over to a Roth IRA until it has been in the account for five years.

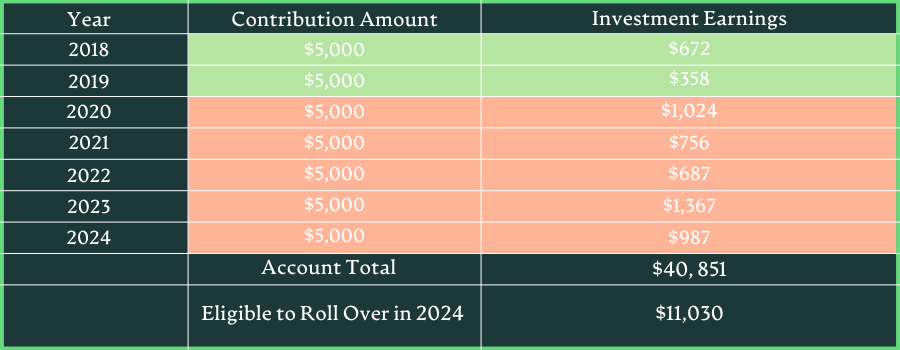

- This chart is an example of how the 5-year rule would affect your ability to roll over funds in 2024. It is important to note that in 2025, 2020’s contributions and earnings would be freed up to roll into a Roth IRA as well.

- There’s a $35,000 lifetime cap on Roth IRA rollovers for each 529 account beneficiary.

- At the current rate, that is replacing 5 years of your child’s contributions. If they are working and can save $7,000 as well, they can put that in a 401k, HSA, or brokerage account. It is likely that the lifetime cap will increase over time, much like the Roth IRA contribution limits have, but that is not a guarantee.

- Roth IRA income limitations are waived for 529-to-Roth IRA Rollovers.

- No need for backdoor 529 rollovers. Thank goodness as what a mess that could have been! This could be a planning factor if your beneficiary finds themselves in a high income earning job out of high school or college or if you would like gift money to children or grandchildren in a tax efficient manner.

If you’re concerned about the assets in an overfunded a 529 plan, you already have other options. Parents and grandparents can switch designated beneficiaries at any time and continue using a 529 account for qualifying educational purposes. Your first child chooses not to go to college, no worries, change the beneficiary and use the funds for your second. Plus, up to $10,000 of 529 plan funds can be used to pay off qualifying student loans. If you’re trying to remove money from a 529, take a student loan of $10,000 and then withdraw $10,000 to pay off the loan immediately. Finally, if the child earns a tax-free scholarship, parents can take an equivalent amount out of the 529 plan without the 10% penalty (though the earnings portion of the distributions will be taxable). This exception for distribution extends to your child going to a US Service Academy or receiving an ROTC scholarship.

529 Plans should still be viewed as education specific accounts and fairly limited as to their scope. This rule along with other recent additions have made the accounts more attractive and less restrictive. Overall, most savers should still view these new additions as potential backup plans for unplanned windfalls, scholarships, or overfunding rather than a direct retirement savings plan.

Follow us on social media below: