03/21/2024

Planning for Restricted Stock Units

Geoffrey Schaefer, CFP®

February 19th, 2024

One of the most common forms of stock compensation is the Restricted Stock Unit (RSU). This is a way for employers to reward employees and to have that reward tied to the performance of the company stock. It also incentivizes employees to stay at the company because the employer often ties a vesting schedule to the benefit. So, the employer gets to offer a compensation package that promotes retention, and the employee gets regular bonuses in the form of stock. Sounds good for both parties, but then here is the question:

What do I do with my RSUs?

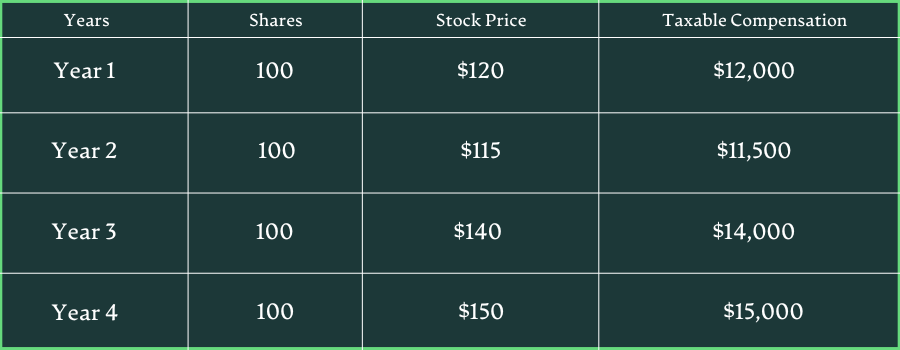

First, let’s look at an example RSU award to understand how these benefits work. Let’s say you work at XYZ company and in your first month, they award you with 400 shares of company stock that vest over the next four years, 25% per year. As of the grant date, this benefit has absolutely no value. The units only vest and become company stock on the vesting dates. So, after 365 days, you will receive the first 25% or 100 shares. Here is a table to show what the value of that award would be:

What are the tax implications at these vesting dates?

The important number to understand is the value of the vested shares as of the vesting date. In the above example, at year one, the value is $12,000. This is the amount that is taxed as ordinary income. The entire vested amount is taxable income as of the date of vesting no matter if you keep the stock or sell it. After the vesting date, the stocks are subject to capital gains and losses like any other stock investment.

So, back to the original question, what do I do with my vested RSUs?

You have two options, keep the stock or sell it. A lot of planning can be done within those choices, but that is what your decision boils down to. You can talk all day about the pros and cons here, from a financial planning perspective, it is usually more prudent to sell the stock and redeploy that capital elsewhere, but let’s explore that more.

Why is it a good idea to sell?

That question could be answered with a question: If you received a cash bonus of, let’s say $50,000, would you choose to invest it all into your company’s stock? Most people will answer no, and that is why it makes sense to sell. Tax-wise, a cash bonus and a RSU are treated no different, so the proceeds of both can be used in a similar manner. Pay off high interest debt, fund a vacation and invest elsewhere- all options for bonus dollars and RSU proceeds.

Now for the investment side of the decision. A lot of people love the company they work for and believe in the work they do every day, but is that a good investment thesis? From a risk standpoint, your salary, 401(k), healthcare, and future growth opportunities are all tied to this company, do you need to concentrate your financial situation more by owning more and more stock?

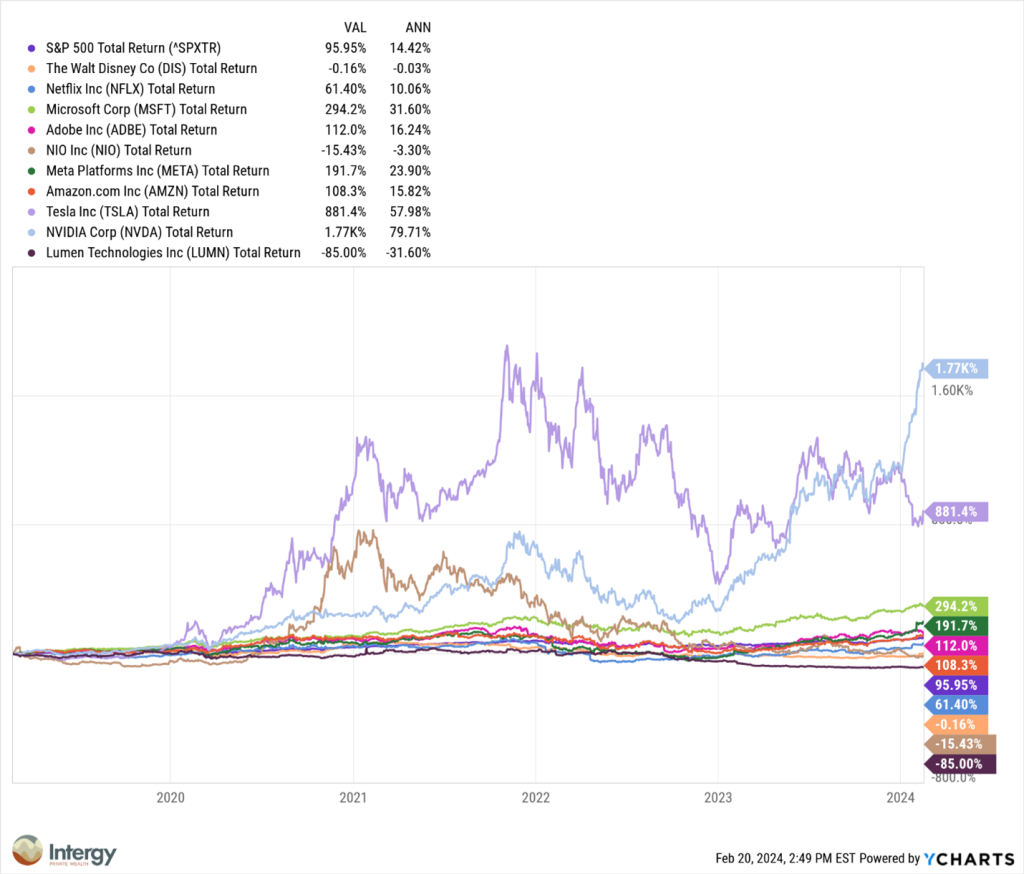

Here is a graph showing the S&P 500 and 10 of the most googled stocks of 2023.

Let’s look at the S&P 500 first- a total return of over 95% the past 5 years. Not too bad at all and would probably be sufficient for many planning goals. Two stocks that stick out are NVIDIA and Tesla up 1,770% and 881% respectively- staggering returns and potential unsustainable, but time will tell. At the bottom end you can see Lumens Tech, Nio, and Disney all with negative returns. Of the buzzworthy stocks, some did great, some didn’t. Only one position on here represents a diversified allocation and that is the S&P 500. It is a basket of over 500 companies that reweights and reprices over time. A diversified basket of stocks poses less risk and still has the potential for an attractive return over time. Not bad, but you might say, I believe in my company so much, I want the potential in the future. Guess what, you have unvested RSUs! The unvested amount continues to grow with the current price, so even if you cash out, your unvested amounts will grow and then that new amount will vest at the next interval.

A good thing to remember here is that usually half of stocks will underperform the market and in some years less than a third. 2023 was remarkably low where only 25% of individual stocks outperformed the S&P 500 as a whole. According to a study by Hendrik Bessembinder, finance professor at Arizona State University, 58% of stocks failed to beat the return of treasury bills during their lifetime and another 38% beat T-bills, but by a very moderate margin. Just 4% of stocks accounted for substantial wealth creation since 1926. This just means it’s really tough to know which side of the list your company stock will end up year in and year out.

*From Bloomberg Finance and The Visual Capitalist https://www.visualcapitalist.com/sp/whats-driving-u-s-stock-market-returns/ *ASU Carey School of Business https://wpcarey.asu.edu/sites/default/files/2021-10/do-stocks-outperform-treasury-bills.pdf

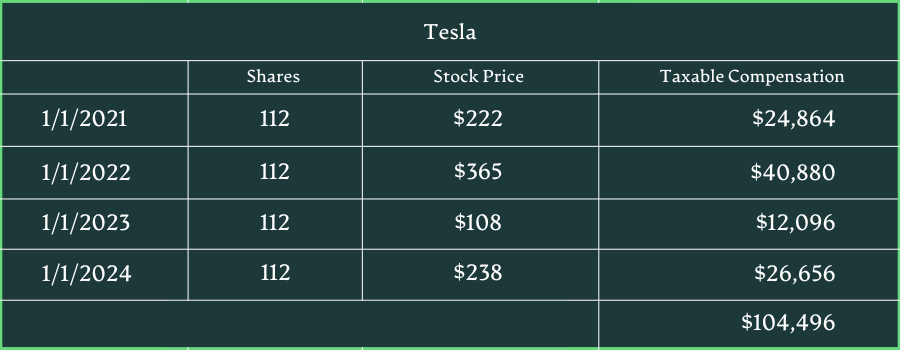

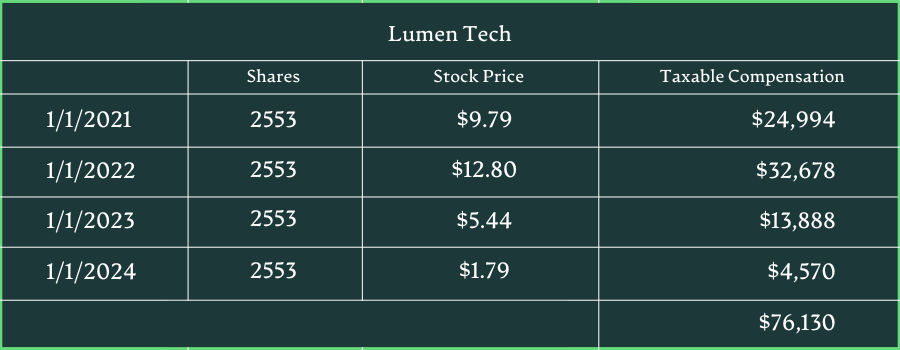

To get an idea of how stock price can move the benefit, let’s take the first RSU example and plug in numbers for Tesla and Lumen Tech over the past four years. Both companies offered you $100,000 of RSUs. Tesla has a higher stock price, so you got 448 shares, whereas Lumen gave you 10,212 shares. Both equal $100,000 as of the grant date.

You see Tesla is a roller coaster, but you sell some high, you sell some low, and you end up with just over $104,000 of compensation over four years. In the case of Lumen, it is mostly a straight drop down, but you still cash out periodically and end up with $76,000 of compensation. If you had left more in Tesla, you would have slightly more, if you’d stayed invested in Lumen, you’d have less, but both of these have the benefit of hindsight. You don’t know what your stock price will do in a year and the fact remains that the more diversified your investment allocation is, less risk is present over time along with a narrower range of potential outcomes.

Summary of reasons to keep the RSU as it vests:

- You have enough investments elsewhere that the lack of diversification is inconsequential.

- You are an insider and must trade around set windows of time.

- You are employed with a small market capitalization company with tremendous upside potential.

- You absolutely love your company stock- make a plan to work around this.

Reasons to sell:

- Most of your income and net worth are tied into this organization, no need to concentrate further. You want to lower your investment risk.

- You are not attached to the company stock and prefer to reallocate elsewhere.

- The proceeds from the RSUs could align your money with your values by being reallocated toward other goals- debt paydown, college funds, giving, etc.

There is no right or wrong answer to what to do with your RSUs. That is why personal financial planning is so subjective. A financial planner can help determine the best course to align this capital with your values.

Now for the tax portion. A huge part of planning with RSUs is to remember taxes. 100% of the value of the vested stock is taxed as ordinary income in the year it vests. For someone with substantial stock compensation this could be hundreds of thousands of dollars. You have a few options to take care of this. First is to set aside cash to pay the tax quarterly. If you want to hold as much stock as possible this may be a good option. The other option is far more practical. You sell a percentage of the stock and withhold it for taxes at every vesting date. The awesome thing about this option is often, you can make selling to cover taxes and then withholding that amount to the IRS an automatic function. So, every vesting date, a certain percentage of your stock sells and the proceeds sent to the IRS with no action or second thought from you. This is right for folks who want to maximize automation or plan to sell the bulk of the vested stock anyway.

Another thing on taxes is to know your vesting date value. You see this on your transaction reports every year. This is valuable to know because it is your basis in the stock. The amount that you will pay capital gains on if you sell higher or have a deductible loss if lower. Sometimes the brokerage firm reports your cost basis as $0. This is huge because it means your company reported the RSU value as taxable income (which they should), but your 1099 from the brokerage firm is showing the entire value as a capital gain which is inaccurate and would subject you to short term capital gains on the same amount- nearly a double tax. A huge thing to double check annually.

Stock Compensation is a huge part of many people’s financial picture, and it should not be crippling. There are taxes to consider, investment opportunity and risk. The good news, with a solid financial plan, a lot of these decisions become clearer. Planning around restricted stock is simply another way to plan for your future, live life today and align your use of capital with your values.

Follow us on social media below: